REUTERS/Rafael Marchante

Welcome to Insider Cannabis, our weekly newsletter where we’re bringing you an inside look at the deals, trends, and personalities driving the multibillion-dollar global cannabis boom.

Sign up here to get it in your inbox every week.

Happy Friday readers,

Cannabis policy has gone from a quirky sideshow in Washington, DC to one of the Capitol’s main events, as powerful Democratic lawmakers continue to push for cannabis reform initiatives, from legalization, to banking reform, to pardons for cannabis-related offenses.

While the path for outright legalization is narrow this year as long as the filibuster remains in the Senate, it’s clear that it’s a priority for Senate Majority Leader Chuck Schumer.

That has fueled a rally in the sector, as cannabis companies in the US and Canada look to raise money and pursue acquisitions to prep for what many say is the inevitability of legalization.

In other news, I went on CTV - one of Canada's most-watched TV networks - to chat about cannabis legalization and the Reddit-fueled stock rally. You can watch the segment here, and let me know what you think.

Yeji and I will have lots of exciting stories next week, including a reported look at M&A trends from top executives at major cannabis firms.

-Jeremy (@jfberke) and Yeji (@jesse_yeji)

Here's what we wrote about this week:

See the 13-slide presentation that a Facebook engineer and a Wall Street analyst used to convince investors to bet on a new kind of software tool for the cannabis industry

Canix is a software company that helps cannabis businesses manage their day-to-day activities and operations. Led by cofounders Stacey Hronowski and Artem Pasyechnyk, who hail from companies like Facebook, Cowen, and H.I.G. Capital, Canix recently closed a $2.5 million round to further grow its operations to become the one-stop shop for cannabis operators.

Executive moves and news

- Eaze's former CEO Jim Patterson is facing federal charges filed by Manhattan prosecutors in connection to a case that accuses two other individuals of a scheme to deceive banks into handling $100 million worth of cannabis-related charges, as reported by Law360.

- Cannabis advisory firm Viridian Capital announced on Thursday that Wall Street veteran Greg Coleman would be joining the company as Head of Capital Markets.

- The US Hemp Roundtable announced its 2021 slate of national officers, including executives and activists.

- Dr. Oludare Odumosu is taking over as CEO of medical cannabis firm Zelira Therapeutics. Former CEO Dr. Richard Hopkins stepped down in February.

Deals, launches, and IPOs

- Kanabo, a medical cannabis vape company, went public on the London Stock Exchange on Tuesday. It's the first cannabis company to go public in the UK, and founder Avihu Tamir told Insider he hopes it will pave the way for London to become a center of medical cannabis. Kanabo shares quickly doubled on debut before slipping later in the week.

- There's another cannabis SPAC. Choice Consolidation Corp., led by former Cresco Labs president Joe Caltabiano, began trading on Canada's NEO Exchange on Friday. The offering raised $150 million.

- Cannabis ag-tech firm Agrify raised $75 million through a common stock offering.

- NBA All-Star Chris Webber and investment fund JW Asset Management announced on Tuesday they would be launching a $100 million cannabis impact fund that would invest in entrepreneurs of color in the cannabis industry.

- Psychedelics company MindMed announced on Thursday that it would be acquiring digital health and AI company HealthMode for around C$41 million in stock and C$300,000 in cash.

- HEXO Corp. announced on Tuesday it was acquiring Zenabis Global for C$235 million in stock, marking the latest blockbuster M&A cannabis deal.

- GrowGeneration acquired Grow Warehouse, a chain of hydroponics centers, giving the combined firm a larger footprint in Colorado and Oklahoma.

Policy moves

- New York Gov. Andrew Cuomo announced more details around the state's adult-use cannabis program, including how the earmarked $100 million social equity fund will be allocated and details surrounding home delivery services.

- The Drug Policy Alliance released a series of six reports outlining how the War on Drugs has contaminated the systems people interact with in their daily lives beyond incarceration, including education, employment, housing, child welfare, immigration, and public benefits. It's worth your time.

- Kentucky lawmakers are pushing two separate bills that would legalize cannabis in the state, reports WDRB media.

- A report published in the American Bar Association publication The Judges' Journal and written by experts at Rice University's Baker Institute for Public Policy shows that marijuana policy will continue to be inequitable without federal intervention. The authors argue for investing a sizable portion of cannabis tax revenue back into communities impacted by the War on Drugs, led by the federal government.

- A group of leading Democrats, including Senate Majority Leader Chuck Schumer, New York Rep. Jamaal Bowman, and members of the Houses Cannabis Caucus called on President Biden to pardon federal cannabis offenses.

- A new report from cannabis information site Leafly found that the industry now supports over 321,000 jobs, and added 77,300 full-time jobs in 2020 alone. That accounts for 32% year over year job growth - which is especially notable during an economic recession.

Earnings roundup

- Tilray reported Q4 earnings: $56.6 million in revenue and a $3 million net loss. The company reported adjusted EBITDA for the quarter was $2.2 million. Tilray recently announced its plans to merge with Aphria in a blockbuster deal. Read our coverage here.

- MedMen reported fiscal Q2 earnings: $33.8 million revenue and a $68.9 million net loss.

- Neptune Wellness Solutions reported fiscal Q3 earnings on Tuesday, recording C$3.3 million in revenue.

- The Valens Company and Innovative Industrial Properties (IIP) are scheduled to hold earnings calls next Thursday at 11 a.m. ET and 1 p.m. ET respectively. Cronos Group will release earnings 8:30am ET on Friday.

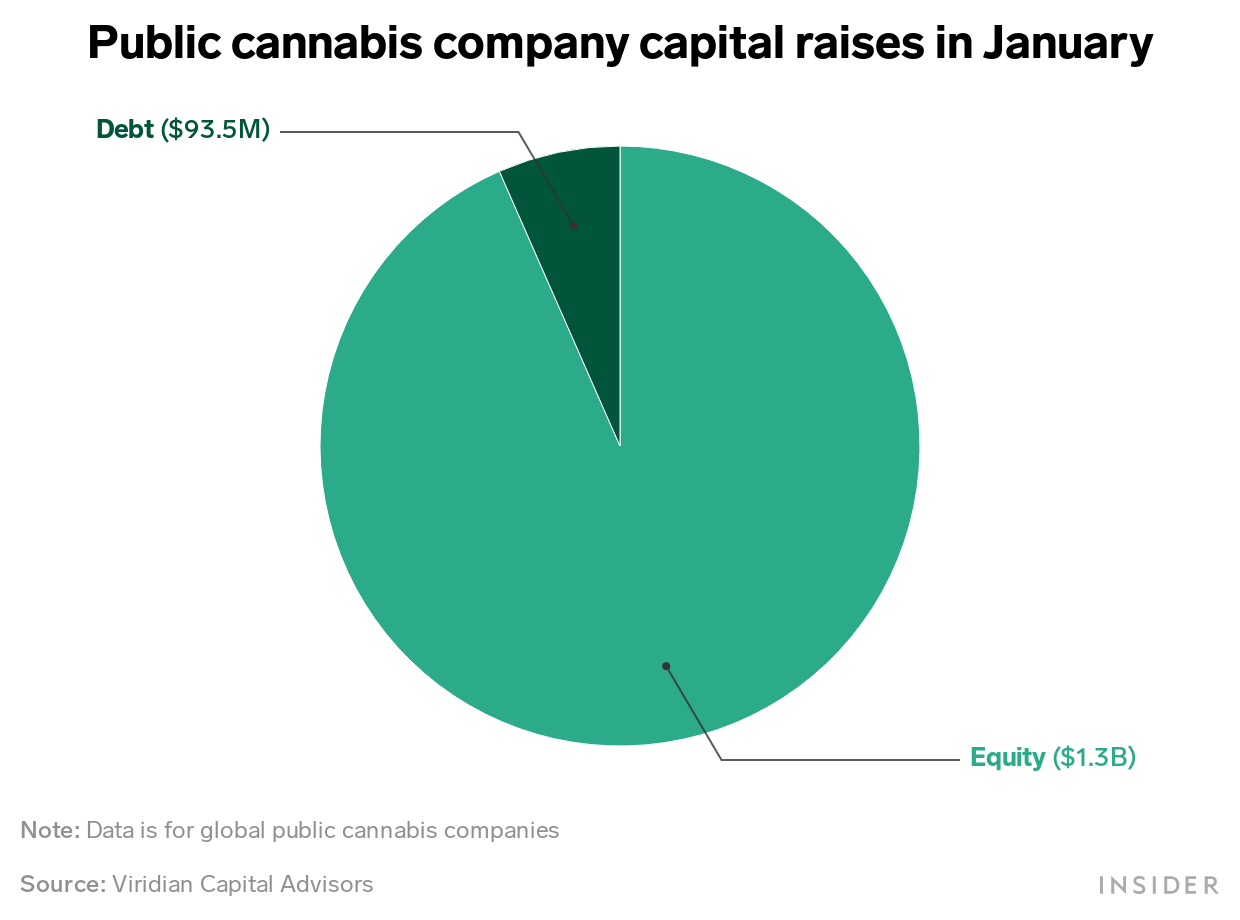

Chart of the week

Public cannabis companies raised $1.4 billion - the vast majority as equity - in January 2021 alone, fueling an M&A boom in the sector, according to Viridian Capital Advisors:

Joanna Lin Su/BI Graphics

What we're reading

Feds Plan To Charge Ex-CEO In Marijuana Bank Fraud Case (Law 360)

How exactly will lawmakers legalize marijuana in New York? (City & State New York)

Lucky Strike-maker British American Tobacco is looking carefully at the cannabis trend (CNBC)

California prioritizes cannabis workers, veterinarians for vaccinations (San Francisco Chronicle)

Land Rush Is On in Four States That Approved Recreational Pot Last Year (Wall Street Journal)

How That High Couple used YouTube to turn a love of weed into a serious side hustle (Los Angeles Times)